It’s OK - Just Do It

The only bad deals are the deals not done

It’s been almost 150 years since William Seward, then U.S. Secretary of State to President Andrew Johnson, barely convinced a skeptical U.S. Congress – by a single vote – to buy Alaska from Russia. For $7M. About two cents an acre. While a pittance today in comparison to the staggering $4+ trillion budget of the federal government today, $7M was a lot of money back in 1867, accounting for almost 2% of the total federal spend that year. And as such, the deal was widely criticized by the media: “Stewart’s Folly” or “Stewart’s Ice Box,” and “Johnson’s polar bear garden.” By 1898 with the discovery of gold in Alaska, there weren’t many critics left for what was arguably the greatest land deal in history, or certainly since Thomas Jefferson doubled the size of the U.S. with the Louisiana Purchase. At a minimum, I suspect that during the Cold War, it would have been pretty uncomfortable having the Soviet’s hanging out a few miles away from Pike’s Fish Market in Seattle.

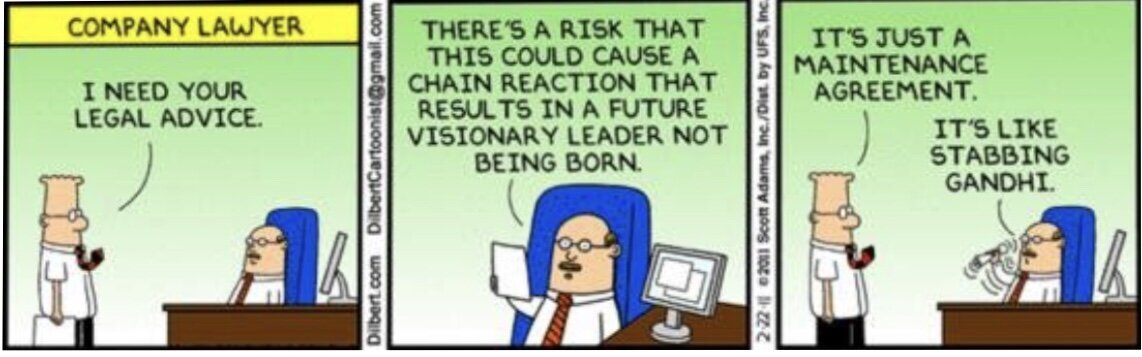

But this isn’t The History Channel. We’re a venture capital fund, this is not about geography, but business. It’s about the deal – the art of the deal. And my point is that in my career, the only bad deals I’ve done were the deals that didn’t get done. Every deal, every sale, carries some amount of risk, and generally the bigger the deal, the bigger the risk. Every new contract includes assumptions, and every time we depend on an assumption, we are taking a chance. These assumptions may include legal issues, usage considerations, certainly financial factors, and much more. And there will always be lawyers, auditors, security professionals, and experts of all kinds who will find lots of reasons not to do a deal. And more commonly, there are almost always those who will want to try and find ways to squeeze every last penny out of a new customer to maximize financial return, even at the expense of delaying the close.

I remember, painfully, a customer engagement several years ago. I was still a “young” CEO at one of my first start-ups, and we were dealing with a much larger company as a potential customer. This was a big deal for us, a very big deal, one that would have been transformative for our fledging business.

The problem, as it often is, was the price: this prospect was demanding pricing much lower than what we were offering our current customers. There was no shortage of people inside the company telling me that we’d be crazy to do this deal, that the price they were asking would never cover our expenses, that the deal would be “unprofitable.” Assumptions.

So I got on a plane and went to see their CEO. One-on-one. No entourage. He was an older guy, a tough guy. A curmudgeon. Rumor was that he once was invited to a white tie gala hosted by the Queen – and got into a fistfight. Anyway, by the end of that meeting, we shook hands on the deal at a price that was a bit higher than the one he’d originally demanded, but not by much. I came back, happy, and turned it over to the sales team to wrap it up, to make our agreement formal via the contract. Well, you already know how this story ends.

In my naiveté, I just assumed that the deal would get done. But the “committees” got involved, and corner cases got covered, and contingencies were inserted, and asses were covered; so by the time the contract was constructed, it looked nothing like the deal that we sealed with a handshake. And the customer, the CEO, was pissed. And he should have been. He had shaken hands on the deal, and the contract that came back looked nothing like the simple agreement he thought he thought he’d sealed. And I was wrong; it was my fault. I allowed “sensibility” to get in front of the deal, which of course never closed. And I’ve never forgotten that painful lesson. But I promised I’d never let it happen again. And it hasn’t.

I’ve done hundreds – thousands? – of deals since then. And sure, some turned out better than others, and some were absolutely terrifying. But as bad as any of those deals may have looked, when I’ve asked myself this simple question, “Honestly, if you had it to do over again, would you still do this deal?” my answer has always been, “yes.” The moral of this story: trust your instinct. Any deal done is better than the one lost. Remember that time kills all deals. Just do it.